Why reputation?

Every increase in reputation strength builds value

Your organisation's most vital strategic asset.

When you build reputation proactively, you do more than gain status. You build the value and impact of your company's most vital strategic asset.

Value is built by understanding how your stakeholders perceive value today, and how you can create value for them in the future. This is Reputational Value (RV). Research by Weber & Shandwick shows it contributes up to 73% to your company's market value.

Impact is built by gaining awareness and attention (recognition) outside of your current network and customer base.

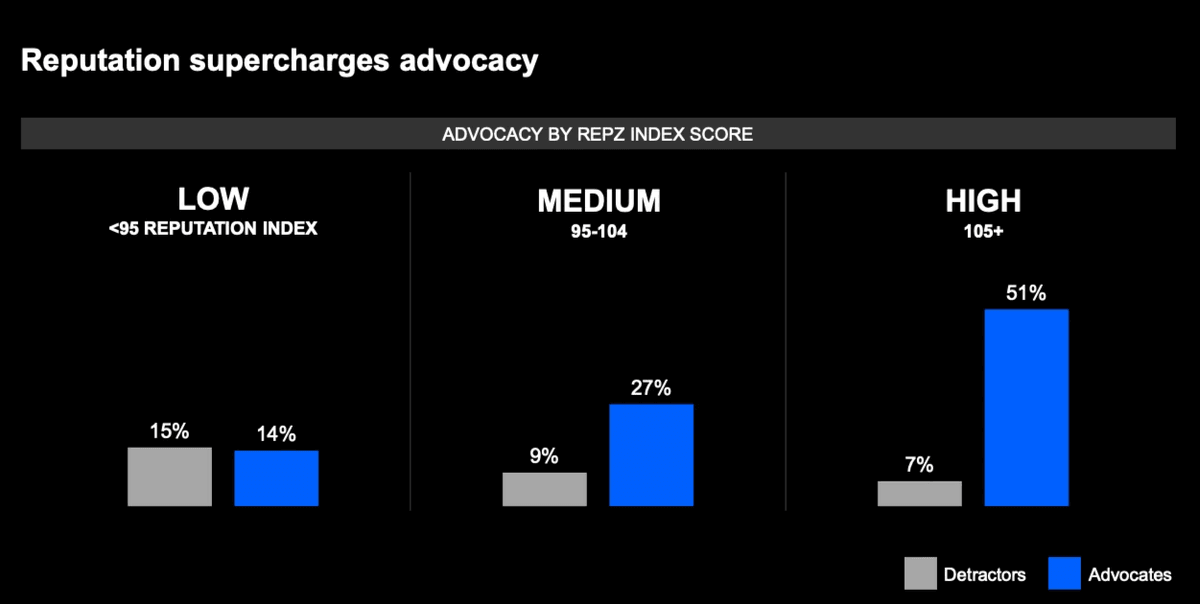

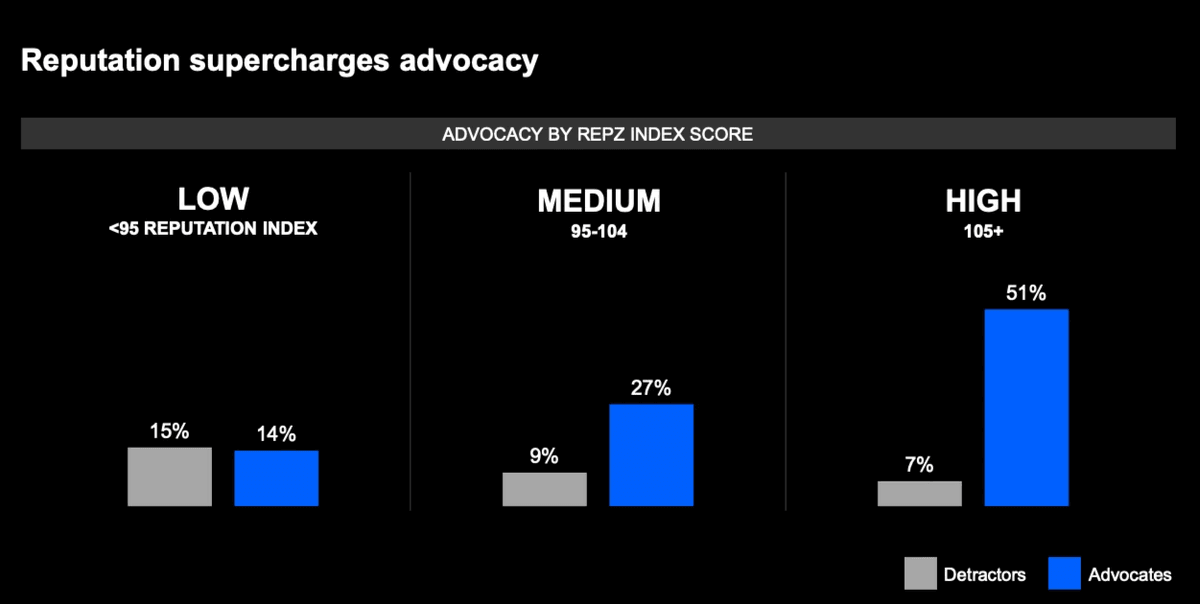

There's now two decades of research linking reputation building to client trust, which translates to advocacy and financial returns.

Here's a small snapshot of some of the research findings through the years.

Quantifying Reputational Value

- In 2005, the Reputation Institute found a one point increase in reputation score led to an average market value increase of $US147M.

- In 2010, Oxford Metrica showed Google had tangible assets worth US$36B, a brand value of $US44B, and reputational value of approximately $US110B.

- A 2013 study found that a 5% improvement in reputation strength led to an average $600M profit increase across S&P 500 companies.

- In 2019, AMO found that reputation upheld corporate value when markets were under pressure. Reputational value grew by 2.1% among the top 15 indices, while total market cap dropped 0.4% in the same period. This equated to $16.77 trillion in value for shareholders.

- In 2024, Echo showed 93% of listed companies in the UK benefited from a reputation contribution worth £719 billion in shareholder value. This was up 3.8% in the last 12 months. Conversely, a poor reputation eroded market cap by 11% on average, costing shareholders £4.6 billion.

Copyright Reputation Sherpa 2025